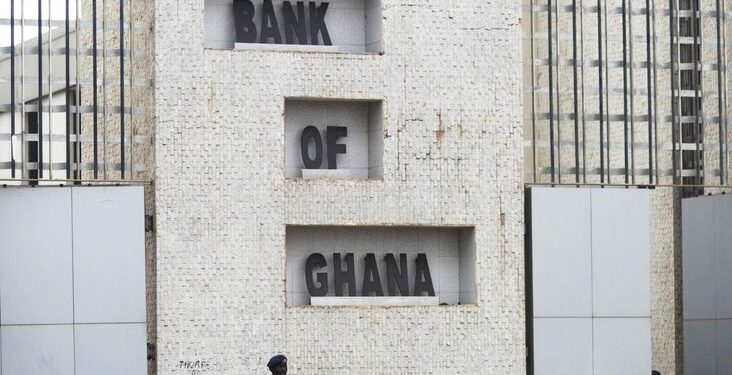

The Bank of Ghana has urged commercial banks operating in Ghana to lower their lending rates as the nation’s inflation rates are declining.

According to the Ghana Statistical Service, the inflation rate for April 2023 was at 41.2 percent, a fall from the earlier recorded 45 percent in March 2023.

The second deputy governor of the central bank, Elsie Addo Awadzi said that this decline in national inflation indicates a positive trend in the domestic economy, with further development anticipated. She was speaking at an event organised by Absa Bank in collaboration with the Mastercard Foundation to launch a loan scheme for small businesses at a 10% rate.

She went on to say there is a likelihood of a better future as the macro economy strengthens and the economy recovers.

“As the economy picks up and there is a signal of improvement in the macro economy, we expect things to get better. Moments ago, before I got here, inflation had dropped to 41.2% for April [2023] from the about 50% some months ago.”

“We as a regulator and at the Monetary Policy Committee project that things will improve. The inflation rate will drop further and lending rates will come down. I, therefore, encourage you all as banks to emulate Absa Bank and bring the lending rates further down,” she added.